Provide $1,200/Year Raises + Benefits to Employees for FREE

Discover how Employers are benefiting from an annual tax savings upwards of $300 to $600 per employee with ZERO net cost AND increasing their employees' NET take home pay!

How The

Tax Smart Benefit Plan Works

How Much You

Can Save:

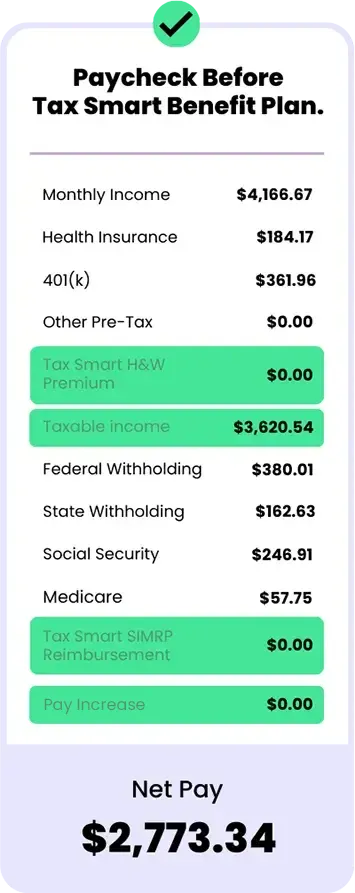

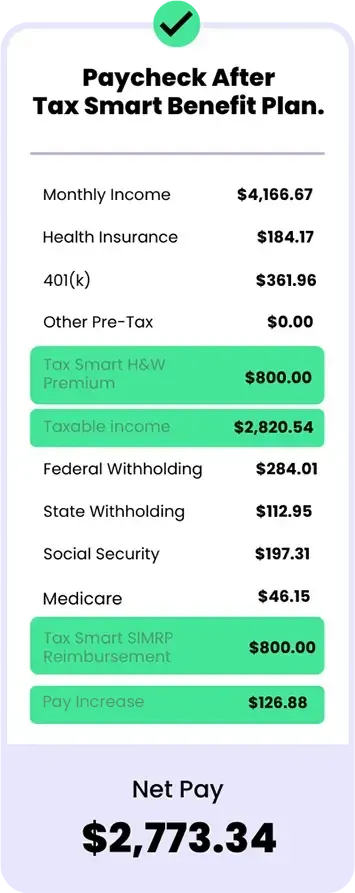

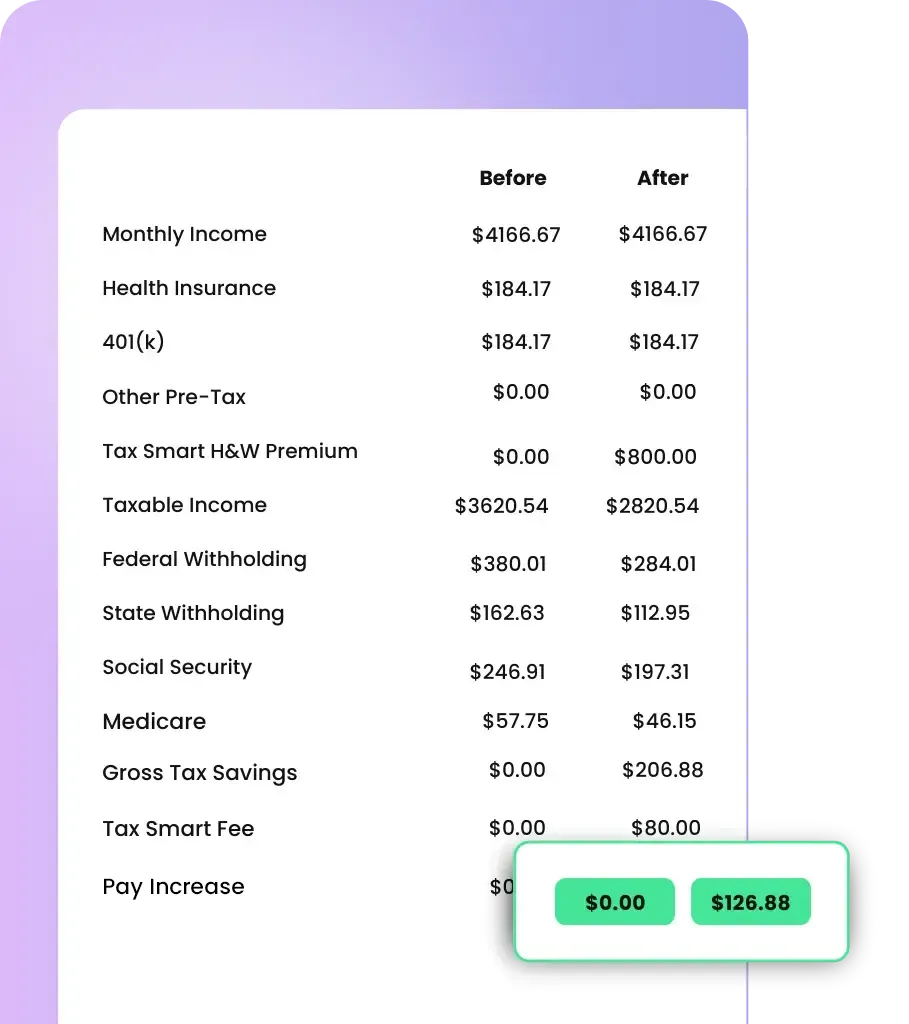

Paycheck Example

Monthly Gross Income Remains The Same

All Pre-Tax deductions are unchanged

This Plan is funded by a Section 125 premium deduction

Taxable Income is reduced by $800 per month

The Participant received an increase of $206.88 due to the Tax Smart Benefit after-tax reimbursement

The Tax Smart Benefit Plan fee of $80 per month is deducted tax-free

Take-home pay remains the same as before the Tax Smart Benefit Plan & Wellness Plan

Estimated Employer Savings Calculator

About The

Tax Smart Benefit Program

Tax Smart Benefit Plan and Wellness does not disrupt or replace any Major Medical Plan. It is an enhancement of your current benefits plans for qualified employees

Tax Smart Benefit Plan and Wellness is a section 125 plan. Prioritizing preventative health and wellness with a comprehensive health management program.

The result is exceptionally high engagement ensuring maximum compliance, healthcare outcomes, and employee experiences.

Tax Smart Benefit Plan and Wellness is at no Net Cost for the employer and employee.

The plan addresses Recruitment, Retention, and revenue concerns that employers have.

We focus on health before it becomes a health insurance issue.

Why Us?

The Tax Smart Benefit Plan is plan that helps employers to retain and attract employees by prioritizing preventative health and wellness with a comprehensive health management program that you can offer to your employees at no net cost to them and a net savings to your company.

Do I Qualify?

Employers with 5 or more employees

All employees must be W-2 and full-time

Employees must have less than 2% equity ownership

Employees must have major medical through an employer-sponsored plan. Either through their employer, spouse’s, or if under 26, a parents’ employer.

A MEC Plan can be installed without out-of-pocket cost to the employee or employer with Capstone to satisfy the group health requirement.

Case Studies

13 Employee Law Firm

Results

Here are the key numbers this client realized when they implemented our solutions.

$179.59

Avg. Efficiency Per Employee

$425.10

Avg. Savings Per Employee

$2,334.67

Amount Each Month for Employees to use on benefits.

$5,877.30

Total Employer Savings

33 Employee Electric Firm

Results

Here are the key numbers this client realized when they implemented our solutions.

$166.55

Avg. Efficiency Per Employee

$477.14

Avg. Savings Per Employee

$5,297.99

Amount Each Month for Employees to use on benefits.

$15,745.49

Total Employer Savings PEPY

42 Employee Chamber Of Commerce

Results

Here are the key numbers this client realized when they implemented our solutions.

$69.97

Average Employee Increase Per Pay Period

$2,195.97

Average Employee Increase Annually

100%

Percentage Of Qualified Employees

$431.87

Average Employer Savings

96 Employee Manufacturing Company

Results

Here are the key numbers this client realized when they implemented our solutions.

$69.67

Average Employee Increase Per Pay Period

$1,811.32

Average Employee Increase Annually

100%

Percentage Of Qualified Employees

$467.44

Average Employer Savings

$1,746.09

Net Savings Per-Pay-Period

$44,874.13

Potential Annual Savings

308 Employee CPA Firm

Results

Here are the key numbers this client realized when they implemented our solutions.

$80.86

Average Employee Increase Per Pay Period

$2,102.46

Average Employee Increase Annually

99%

Percentage Of Qualified Employees

$726.07

Average Employer Savings

$8,601.18

Net Savings Per-Pay-Period

$223,630.56

Potential Annual Savings

Frequently Asked Questions

(FAQ)

THIS SOUNDS TOO GOOD TO BE TRUE. IS IT?

No, it is 100% legal. This is a tax-qualified plan with a wellness focus that uses

tax advantage provisions under the Internal Revenue Service codes “Section 125 Cafeteria Plan and codes 125, 106, and 213(d)” and ACA wellness rules.

CAN I KEEP MY CURRENT MEDICAL PLAN?

Yes, it is actually a requirement of this program that you offer one, but you donot have to replace it, we can take over the plan for ease of administration.

HOW DO YOU REIMBURSE IN THE SAME PAYCHECK?

This is achieved by employees being active and participating in our healthmanagement program through various programs including monthly wellnesshealth coaching.

CAN EMPLOYEE’S KEEP ANY MONETARY EFFICIENCY?

The answer is yes, however, they may have a tax implication. Ourrecommendation is for the employee to use those funds on 213(d) qualifiedproducts through payroll deduction.

SO, WHAT CAN EMPLOYEES USE THE DOLLARS FOR?

The program allows them to use their benefit reserve dollars on 213(d) qualified products such as dental, vision, life, disability, cancer, accident, and critical illness insurance.

HOW LONG HAVE THESE PLANS BEEN AROUND?

Wellness plans have been around since the passing of the Affordable Care Act,which opened the door to structure these plans in their current format.

Contact Us Today

Interested in learning how the Tax Smart Benefit Plan Plan can be implemented into your company?

Book a call with one our team members and we can walk through any of your questions, see if your eligible and draft a savings template.

Tax Smart Benefit Plan

575 S Wickham Rd, Ste F, PMB 221

Melbourne, FL 32904

Phone: (321) 294-8882

This site is not a part of the YouTube, Google or Facebook website; Google Inc or Facebook Inc. Additionally, This site is NOT endorsed by YouTube, Google or Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc. YOUTUBE is a trademark of GOOGLE Inc.

© 2026 Tax Smart Benefit Plan • All Rights Reserved • Privacy Policy • Terms & Conditions